Among the case files preserved at the Archives Nationales d’Outre-mer under call number C2 164 is one of the fiercest critiques of the activities undertaken by the European trading companies in India. Penned by Father Saint-Estevan in 1776, it states that the trading companies, including the French East India Company, consisted of ‘mere merchants wielding despotic authority that resulted in the loss of more than 20,000 of their kings’ subjects, ruined legions of their compatriots and saw more than a million Indians perish.’ The reason for this critique? During their time in the country, the companies certainly delegated their power in extraordinary fashion, ran large-scale global operations and generally symbolised the dynamic nature of a bourgeoisie against which Father Saint-Estevan was then leading the charge. They became complex objects of history that must not be oversimplified.

These companies marked a moment in capitalist evolution and were the linchpins of a ‘proto-globalisation’ under the aegis of Europe. Let us remind ourselves of the facts: In 1598, the risks associated with an expedition to the East Indies, following a route controlled by the Portuguese, forced the once rivalling ship-owners of the Dutch Republic to join forces. The success of the return voyage in 1599 continued with the formation of the Vereenigde Oostindische Company(V.O.C.) in 1602. And it was this voyage that inspired Elizabethan England to create the East India Company (E.I.C.) in 1600. As the first true private joint-stock companies with profit-sharing and dividend schemes, and supported by national banks (the Bank of Amsterdam in 1609 and the Bank of England in 1694), these national companies were testament to the process that was modernisation of the State. Without royal privilege, there were no companies or banks. These entities illustrated an acute notion that politics and business were two faces of the modern monarchy’s power.

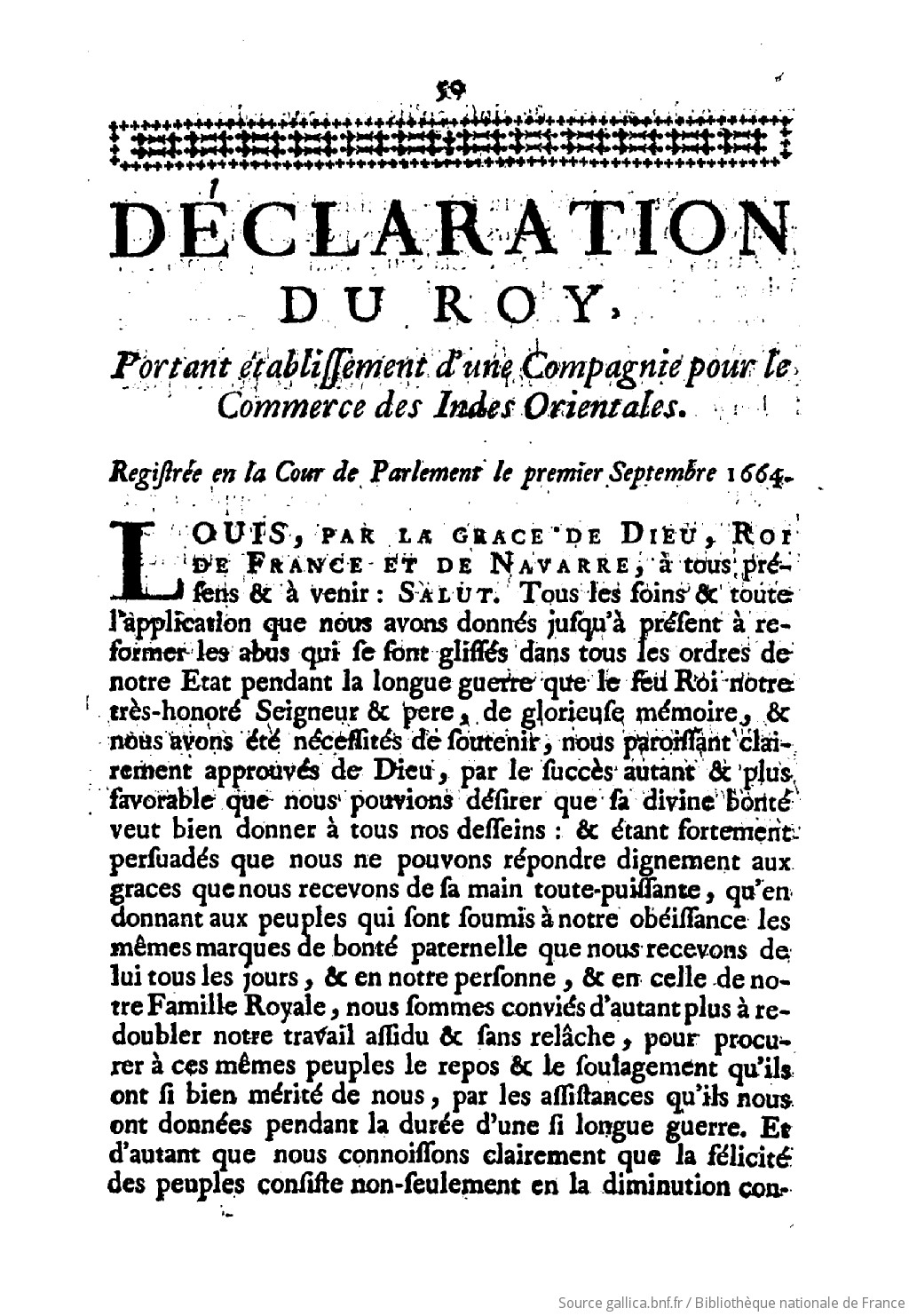

And it was this approach that also governed the formation of other East India Companies, including the French East India Company, between the 17th and 18th centuries. The political and religious rivalries in Europe were certainly conducive to it. In 1626, Richelieu began criticising the shipowners’ associations, labelling them ‘the prey of our allied princes and corsairs, because they are not as financially strong as a large company.’ It was not until 1661 that a shipowners’ meeting was held under the aegis of Colbert. A statement of royal absolutism, mercantilism and company business went hand in hand. The edict of 4 August 1664 forming the French East India Company established provisions that would make it more ‘royal’ than others. The French East India Company received 15 million pounds in capital and exclusive privileges that included a monopoly over trade in Indian and Chinese products. The sovereign held a 5th (20%) of the shares, was represented by a Master of Requests, and appointed the 8 directors. The Danish East India Company, the Ostend Company, and the Swedish East India Company adopted this organisational format in 1616, 1722 and 1731 respectively. So it was that the French East India Company had both role models and imitators.

And these companies faced a steep learning curve in Asia. England’s East India Company had to wait until 1635 before it started turning over adequate profit. Its ruined French counterpart was forced to restructure in 1685, with new directors and an injection of 700,000 pounds into its capital. The Ostend Company, meanwhile, was driven out by the pressure of its competitors. Given the scale of the task, it is easy to see why. As mentioned, the handling of business was facilitated by a new naval power. The number of European shipping lines bound for Asia continued to increase until the late 18th century, with the Indiamen, Returnships and company ships almost resembling warships. These tools required a well-oiled organisational approach, which the sovereigns encouraged by allowing the use of dockyards and warehouses – granted by Louis XIV in Lorient in 1666 – and which was expressed through grand headquarters at the likes of Rue Vivienne in Paris and Leadenhall Street in London. The return cargo consisted of spices, tea or coffee, as well as raw, dyed or painted cotton textiles. High-value items, such as porcelain or furniture, made up the bulk of the return cargo from China,

while its counterpart from India comprised saltpetre, indigo, dyewood and even cowrie shells, used by slave traders. Purchases were made in cash by virtue of large-scale shipments of money obtained in Cadiz. The East Indies were, as the saying goes, the ‘money pit of Europe’. While the geographic side of things appeared to be under control, time still remained a problem: the return trip to India took 8 to 12 months, and China 12 to 14 months, with a number of stops needed along the way. So it would take one order six months to be fulfilled, sales would have to be planned without knowing the context in which the purchases would be made, and complex business would take years.

This ‘dyschronia’, if we can call it such, explains the delegation of powers and the quasi autonomy in managing the colonial territories, including the use of military force. In what was an unstable situation, private armies became tools used by the hegemony. A stark sense of duality between European and Asian management emerged within the companies – one aligned with the royal court and the other with the shareholders. But, above all, the trading posts remained places of business. Their geography reflected both mercantile interests and local contingencies. The approaches used were dependent on location and the players involved; the brutality of the VOC in Java after 1609 contrasted sharply with the great fragility of the lodges, which were sometimes called on to act as fortified trading posts. This can be explained by a number of factors: 1) The desire to establish a commercial system meeting the relevant needs and to form a monopoly here, 2) the fiscal interest of the Nabobs inviting the companies, and their ability to command respect. And thirdly, the presence of personnel pursuing their own interests, driven by a thirst for recognition.

Exceptional figures such as Albuquerque, Coen, Dupleix and Clive won fame here when circumstances permitted. In many cases, these circumstances tied in with the disintegration of the Mughal Empire. The trading posts of the second French East India Company were particularly sensitive to these dynamics, with the paravanas and the firmans having been negotiated in contravention of promises made by military alliances. These companies also continued to serve as back-ups for the monarchy, spreading Christianity and defending the colonial territory during times of conflict. The convergence of Indian and European contexts was thus key. And so it was that Dumas’ acquisition of Karikal in 1739 brought revenue, guaranteed supplies and a robust textile production industry, and signalled increased involvement in Indian business affairs. Dupleix’s politics marked a major shift towards the War of the Austrian Succession. The transfer of the sarkars, the provinces of Mazulipatam, to the French East India Company by the subedar of the Deccan helped finance Bussy’s army in Hyderabad, granted exclusivity over painted canvases, and ensured a revenue that covered all its business expenses. On the English side, Clive’s actions can be considered an appropriate response, using the same resources and pursuing the same objectives, taking advantage of the Seven Years’ War to eliminate rivals and seize control of Bengal, which, at the time, was the veritable economic powerhouse of India.

1763 thus marked the great turning point in the history of the East India Companies. The British East India Company was outperforming its rivals, who consequently fell under its influence. For these defeated companies, the Treaty of Paris was an opportunity to reassess. The suspension of privileges in 1769 was an ideological decision that gave India access to private shipowners, plunging the trading posts into a deep crisis. The Danish East India Company followed suit in 1772. But the idea of an East India Company endured until the early 19th century: ‘I will only accept one purely commercial company, without a navy’, wrote Saint-Estevan, observing the English East India Company’s progress. This was precisely the type of company that, having been restored in France in 1785, found itself up against the EIC’s domination and the hostility of the agreement. For its part, the Swedish East India Company disappeared in 1813. And even for the victors, it was a situation that sparked fierce conflict, fuelled by successive scandals, that eventually decimated the EIC’s commercial significance in 1813 and imposed tight controls on its management – to such an extent that, by 1857, the company’s existence became merely an awkward anachronism.

Published in october 2024

.png)